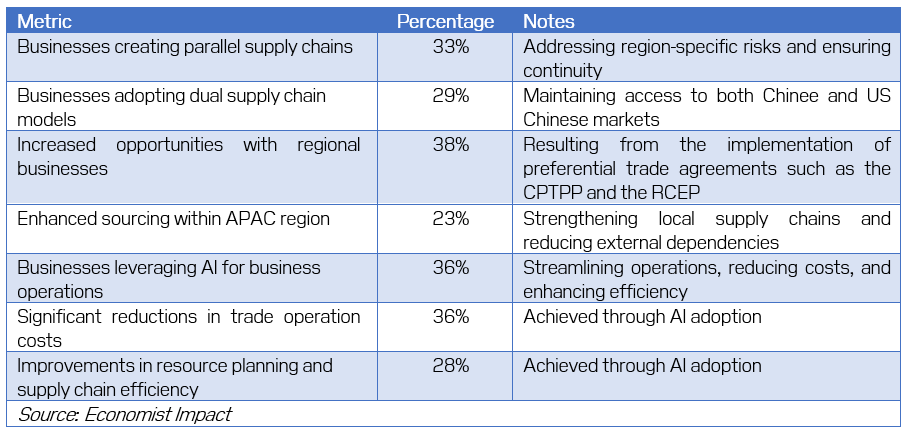

33% of businesses based in the Asia Pacific (APAC) region are creating parallel supply chains to avoid disruptions caused by geopolitical risks, while 29% are creating dual supply chains to cater for the Chinese and US markets as companies navigate the complexities of increasingly fragmented trade environments.

Research unveiled by Economist Impact and DP World highlights how businesses in APAC are adopting diversification strategies and digital innovation to maintain supply chain resilience in the face of growing trade tensions, particularly between China and the United States.

The fifth annual Trade in Transition study surveyed over 3,500 supply chain executives across the world. The global findings, which were launched at the World Economic Forum, reveal that firms are being forced to adapt at speed to rising protectionism and shifting geopolitical alliances, with business continuity and cost management as chief concerns.

The research outlines three main trends in APAC trade:

Strategic diversification to manage risks and regional pressures

Adoption of “China Plus One” strategies and the creation of parallel supply chains have become more prevalent among APAC businesses, spurring the growth of alternative production hubs in other Asian countries such as Thailand and Vietnam. Firms in APAC are also increasing regional integration and establishing dual supply chains to better mitigate geopolitical risks, reduce costs, and strengthen oversight.

Leveraging government intervention and reconfiguration

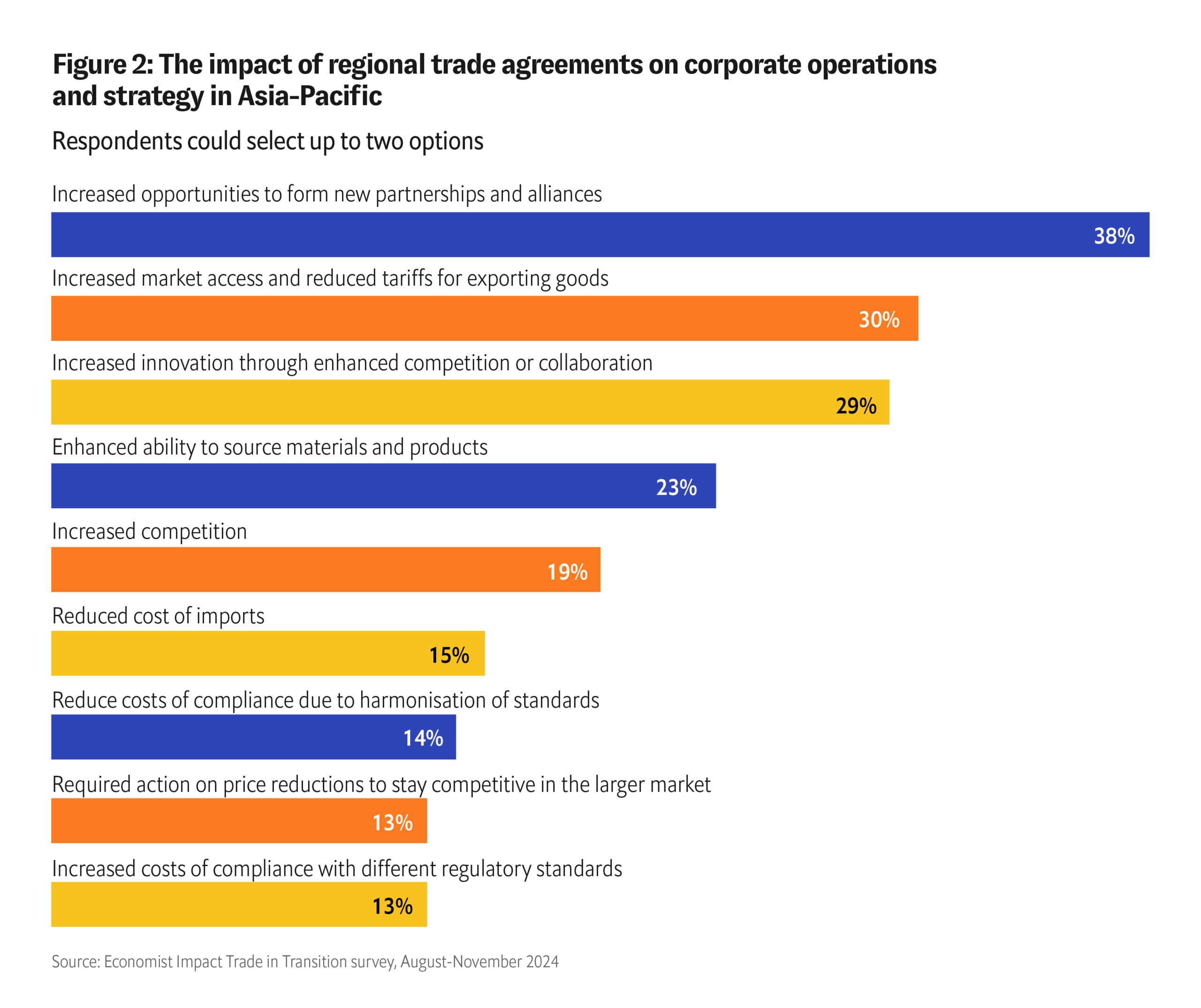

Supply chain regionalisation is further incentivised by the negotiation and implementation of regional preferential trade agreements, which result in enhanced cost control, operational efficiency, and support for local economies. 38% of APAC business leaders saw increased opportunities in the region with the likes of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) in effect, while 30% enjoyed cost savings given reduced tariffs on exports in member countries. Almost a quarter (23%) of respondents also reported enhanced sourcing within the region, strengthening local supply chains and reducing dependence on markets outside the region.

Technology adoption to counter labour shortages and enhance efficiency

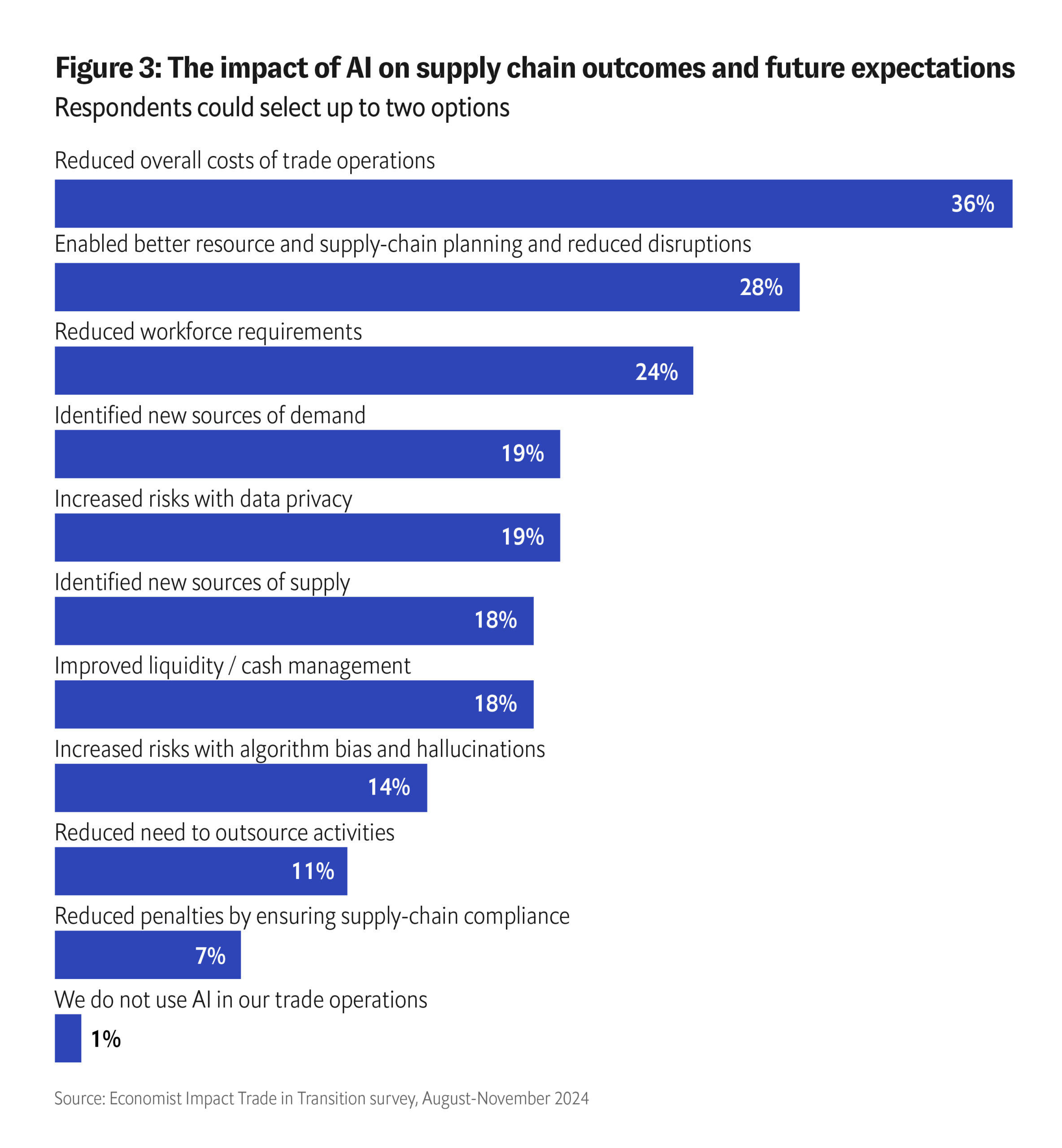

Businesses continue to invest in emerging technologies such as automation and artificial intelligence to address workforce shortages and sustain productivity. These investments are paying off, with 36% of APAC business leaders reporting significant reductions in trade operation costs and 28% seeing improvements in resource planning and supply chain efficiency. Governments in the region are also supporting technological transformation, with initiatives such as Japan’s Society 5.0 empowering businesses through digital innovation.

Glen Hilton, CEO & Managing Director, Asia Pacific, DP World, said: “The Asia Pacific region is in an era of significant transformation. As businesses in the region implement bold strategies—diversifying supply chains, capitalising on regional trade deals, and adopting frontier technologies—to drive expansion, they must also balance ambition with caution to sustain momentum in the face of global geopolitical instability. Our customers can count on DP World to help them strike this balance. With our suite of end-to-end supply chain solutions anchored by our strong network of ports and terminals, we stand ready to help businesses design agile supply chains for them to tap on Asia Pacific’s unparalleled growth potential.”

John Ferguson, Global Lead, New Globalisation, Economist Impact, added: “In 2025 and the foreseeable future, global trade will be shaped by three forces: shifting geopolitics, climate change, and a new wave of AI and automation. Yet, businesses are not retreating from international trade but are stepping up to the challenge. Firms that stay agile and cost-efficient will have the edge. Firms that also combine risk management with AI experimentation and openness will be best placed to win in this new chapter of globalisation.”

Discover actionable insights and detailed strategies for thriving in the evolving global trade landscape. Click here to view the APAC report and here to view the full Global report.

KEY APAC INSIGHTS FROM TRADE IN TRANSITION 2025